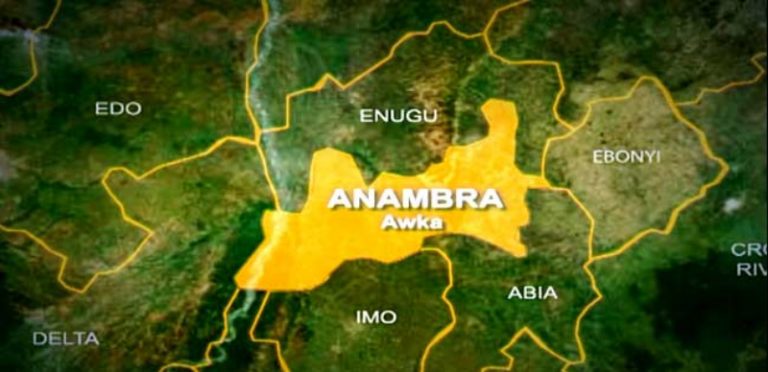

The Senior Special Assistant to the Anambra State Governor on Internally Generated Revenue (IGR), Amara Oyeka, has disclosed a significant increase in the state’s monthly IGR, rising from ₦2.2 million in 2023 to ₦5.2 billion in 2024.

Oyeka shared this during the presentation and validation of research findings from 21 major markets across the state under the Tax for Service (T4S) Project, implemented by the Tax Justice and Governance Platform in collaboration with the Civil Society Legislative Advocacy Centre (CISLAC) and funded by Oxfam Nigeria.

The achievement comes despite persistent challenges, including widespread tax evasion by wealthy citizens and significant revenue leakages. Oyeka lamented that some revenue collectors have enriched themselves more than the government due to systemic loopholes.

*”Most of the guys spoiling the government’s reputation are not working for us. We are doing more work than they do in other states, but the leakages are too many. This is a work in progress, and we shall get there,”* Oyeka stated, calling for collaboration from all stakeholders to sanitize the system.

Stakeholders, including the Chairman of the Anambra State Board of Internal Revenue Service, Dr. Greg Ezeilo, and representatives of the traders, acknowledged the vital role of markets in boosting the state’s revenue.

Dr. Ezeilo, represented by Herbert Ofomata, emphasized, *”Markets are our oil wells in the state. The market financial worth in Anambra is very high, but the government is not getting the revenue it deserves.”*

National Chairman of the Anambra State Markets Amalgamated Traders Association (ASMATA), Aguata Zone, Eze-Igwe Chiedozie, expressed satisfaction, noting that visible infrastructure funded by taxes encourages compliance.

The findings, presented by consultant Dr. David Agu, revealed that over 50% of revenue from markets is diverted into private pockets. This diversion has historically affected the state’s revenue profile.

The Executive Director of the Social and Integral Development Centre (SIDEC), Ugochi Ehiahuruike, highlighted that the T4S Project aims to bridge the gap between taxpayers and service providers, fostering accountability and public trust.

In his remarks, the Vice President of the Anambra State Association of Town Unions, Ikechukwu Offorkansi, urged the government to address the issue of multiple taxation to enhance trust and compliance among taxpayers.

The collaborative efforts between the government, civil society, and traders aim to sustain Anambra’s revenue growth trajectory, enabling improved public services and infrastructure development.