Commercial banks in Nigeria have commenced charging N100 for cash withdrawals from Automated Teller Machines (ATMs) belonging to other banks, following the Central Bank of Nigeria’s directive on revised transaction fees effective from March 1, 2025.

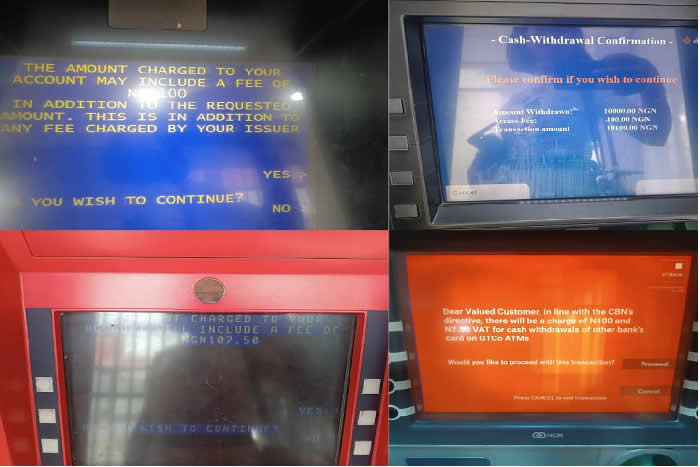

The CBN announced the fee adjustment in a circular dated February 10, 2025. Under the new policy, withdrawals from a customer’s own bank ATMs remain free, while withdrawals of N20,000 or less from another bank’s ATM attract a charge of N100. For off-site ATMs located outside bank premises, an additional surcharge of up to N500 applies.

International ATM withdrawals will be charged based on cost recovery, meaning customers will bear the exact fees applied by the international acquirer.

A survey of banks in Lagos on Sunday revealed that ATMs were loaded with cash to discourage customers from using other banks’ machines and incurring the extra charges. ATMs at Wema Bank, First Bank, Access Bank, Zenith Bank, and Guaranty Trust Bank displayed notifications alerting customers of the N100 fee, with some including VAT charges.

The new charges have sparked complaints from customers, who described the policy as an added burden amid rising living costs. A customer, Eze Chinonso, lamented that the fee would further strain his meagre income, while a social media user, Opel Nnenna, criticised the charges as excessive and urged the government to reconsider.

The Trade Union Congress and the Socio-Economic Rights and Accountability Project have called for the suspension of the policy, describing it as exploitative and burdensome on the public.

The CBN advised customers to use their bank’s ATMs or explore alternative payment channels such as mobile apps and POS machines to avoid the charges.