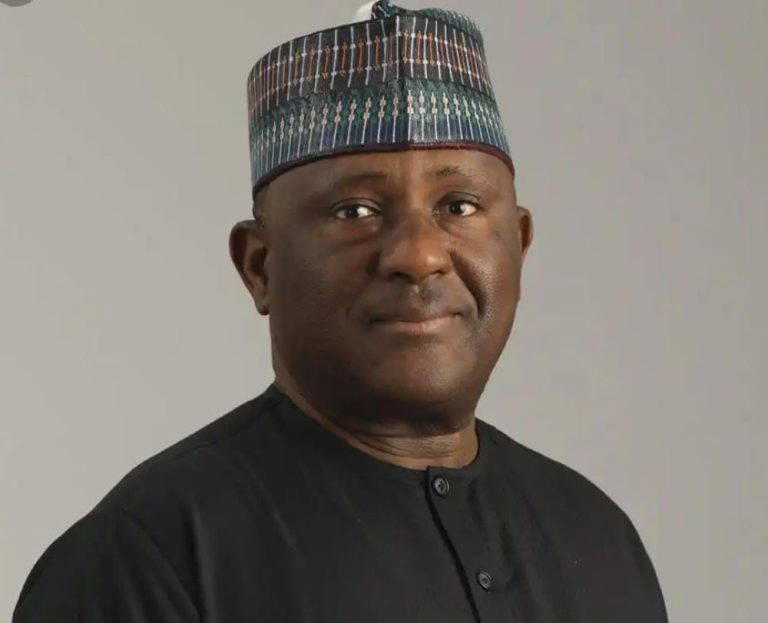

BUA Cement Chairman, AbdulSamad Rabiu, has revealed that the company’s plan to sell cement at N3,500 per bag last year was thwarted by cement dealers, who instead sold the product at inflated prices. Speaking at the company’s 8th Annual General Meeting in Abuja, Rabiu disclosed that while BUA Cement sold over a million tons of cement to dealers at the reduced price, the dealers sold the cement to consumers at prices ranging between N7,000 and N8,000 per bag.

Rabiu explained that the company had to abandon its pricing policy because the intervention, intended to benefit end-users, was instead exploited by dealers who made significant profits from the high margins. “We could not stop the dealers as we had no control over prices in the open market,” Rabiu stated, adding that the devaluation of the Naira and the removal of the fuel subsidy last year further complicated the situation.

Rabiu expressed disappointment that the company’s effort to keep cement prices low was undermined by market dynamics and external factors, such as the sharp rise in the exchange rate. He noted, “When the foreign exchange rate moved from about N600 to nearly N1,800 to the US Dollar, it became more challenging to sustain that price policy.”

Despite these challenges, BUA Cement has continued to work towards stabilizing prices, ensuring that the increase in cement prices remains below the rate of Naira devaluation. Rabiu pointed out that although the cost of cement rose from N4,000 to N6,000 per bag over the past year, this 50% increase is less than what could have been expected given the extent of the Naira’s depreciation.

Rabiu also highlighted the impact of dollar-denominated costs on production, particularly energy costs. “Energy is the biggest cost, and our energy today is denominated in dollars. We buy gas to power our plants, and gas is priced in dollars,” he said, revealing that one of BUA’s plants incurs monthly energy invoices of N15 billion to N16 billion, compared to N3 billion to N4 billion in previous years.

According to the company’s financial report, BUA Cement recorded a 27.4% increase in revenue, rising to N460 billion in 2023 from N361 billion in 2022, driven by an expanding market share. However, the company faced significant cost pressures due to the Naira’s devaluation and inflation, with production costs increasing by 39.5% to N276 billion.

The report also indicated a net foreign exchange loss of N70 billion, with N52.5 billion attributed to finance costs. Despite these financial hurdles, BUA Cement posted a net profit after tax of N69.5 billion and declared a dividend of N2 per share.